“The Trillion Dollar Equation,” video from Veritasium explores the model that spawned multi-trillion dollar industries. More specifically how Bachelier applied Fourier, how Ed Thorp made money applying the model, and finally how Black, Scholes and Merton published the model. Some immediate.trade content and expected ranges come from Black Scholes, but the rest of the content looks to protect the reader from “social science” assumptions Newton accurately dispelled 250 years before BlackScholes. Keep in mind that in 1998 these geniuses singlehandedly undermined the banking system and needed a government bailout following their own formula.

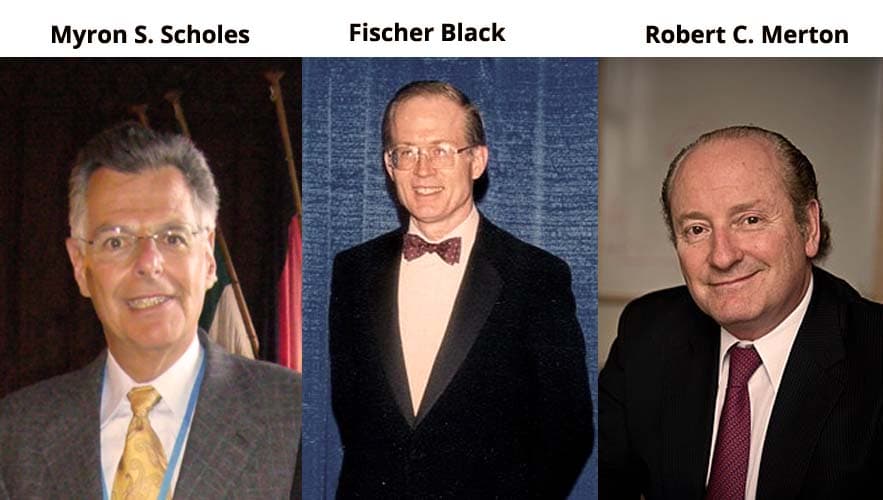

The equation has roots in physics and was used by scientists and mathematicians to excel in the financial markets. However, success in financial markets isn’t guaranteed by being good at math. The video discusses the advantages of options trading, which include limiting downside risk, providing leverage, and serving as a hedge. Options allow investors to buy or sell an asset at a later date for a set price, providing protection against potential losses or the opportunity to profit from price increases. The history of options pricing is also covered, with a focus on Louis Bachelier’s discovery of the utility of options in the late 1800s and the challenge of accurately pricing these complex financial instruments. The speaker shares the stories of physicists like Robert Brown, Louis Bachelier, and Ed Thorpe, who made significant contributions to the understanding of financial markets through their mathematical and scientific insights. Thorpe, for example, pioneered the concept of dynamic hedging and developed a more accurate model for pricing options. The speaker also discusses the groundbreaking work of Fischer Black and Myron Scholes, who derived the famous Black-Scholes-Merton equation that revolutionized the industry and led to the growth of multi-trillion dollar industries such as exchange-traded options, credit default swaps, OTC derivatives, and securitized debt. The speaker also touches on the size of derivative markets and their relationship to the underlying securities, noting that they are worth several hundred trillion dollars globally