David Rubenstein, co-founder and co-chairman of Carlyle Group, believes that the biggest investment opportunity over the next 2 to 3 years lies in the discounted real estate debt market, specifically in large commercial office buildings in major cities. Rubenstein acknowledges the challenges facing some cities, such as public relations issues and declining real estate prices, but he believes that large cities are still attractive to people, especially younger generations. Rubenstein also notes that his data on several hundred companies does not indicate an imminent recession, contrary to Barry Sterlicht’s beliefs. Finally, Rubenstein suggests that commercial real estate is a good purchase if the price is right, as fewer people are currently going into offices.

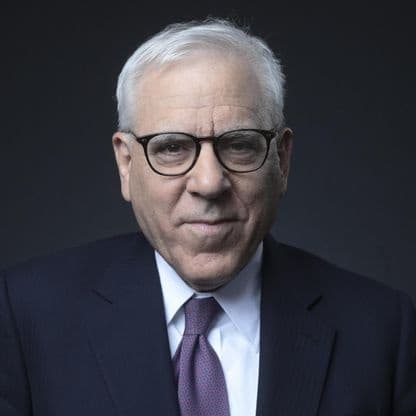

Rubenstein on Real Estate

Greg P

Posted underBenchmark RateBondsCarlyle GroupChinaDavid RubensteinEconomyFederal ReserveFinancial ModelsFOMCforecast