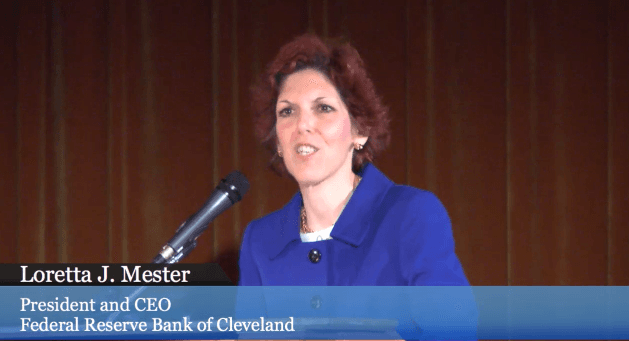

Cleveland Fed President Loretta Mester acknowledges that there has been stronger growth than expected, along with lower inflation and higher long-term rates, which could put downward pressure on inflation. She believes that under-tightening would be a worse mistake than over-tightening and emphasizes the importance of monitoring the economy and achieving a soft landing. Mester expects to mark up her growth projections and suggests that wage growth needs to moderate in order to bring inflation down. She also touches on the impact of labor market developments on wage growth and the strength of the labor market. On the housing market, she notes that high mortgage rates are currently freezing the market, but expects that once inflation is under control, there will be room to bring down mortgage rates.

Giving Themselves a Pat on the Back…

Greg P

Posted underFed GovernorsFederal ReserveInflation