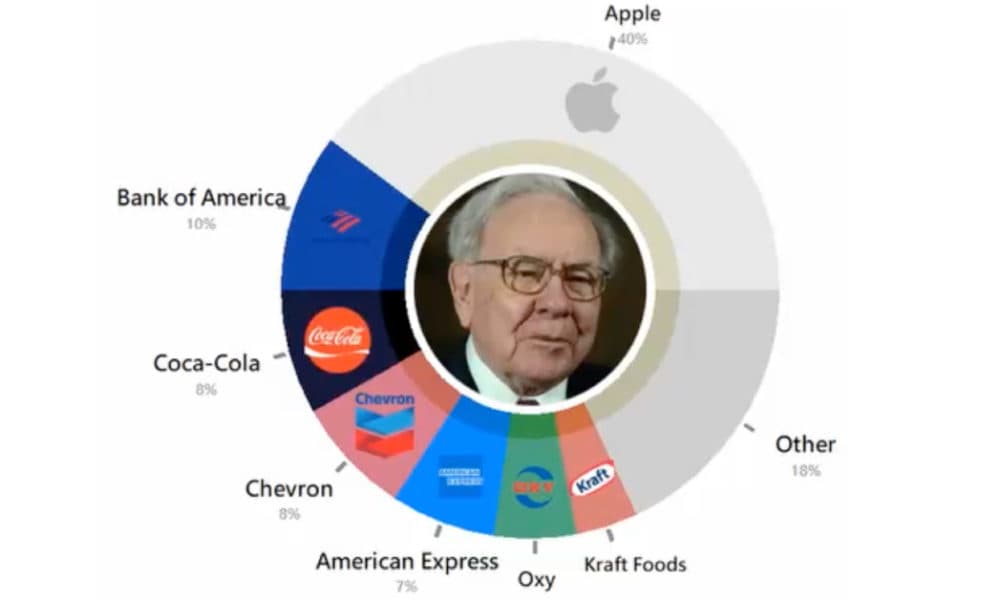

Buffett clarified that this does not reflect a change in view towards Apple’s business or investment attractiveness. Berkshire considers various factors, including tax implications and manager responsibility, when deciding on stock investments. Buffett emphasized that they do not attempt to predict markets or pick stocks based on trends but view them as businesses to serve their investment goals. Apple, along with Coca-Cola and American Express, will likely remain in Berkshire’s portfolio.

Buffett Locking in Gains

Greg P

Posted underAAPLAppleBerkshire HathawayWarren Buffett